I have been using Payoneer since 2012, and I’ve received hundreds of payments through this platform.

Payoneer solved a critical problem for me early in my online business journey. As someone working with international clients and affiliate programs, I needed a business tool to receive payments from companies worldwide without geographic restrictions. While their fee structure still bothers me after all these years, Payoneer remains a reliable payment solution for my business.

This review covers what you need to know about Payoneer (including honest assessments of fees and features) to determine if it’s the right choice for you.

Payoneer at a Glance

Best for: Freelancers, affiliate marketers, and online business owners receiving international payments.

Overall rating: 4.25/5 stars

Key features:

- Multi-currency receiving accounts (USD, EUR, GBP, JPY)

- Global payment acceptance from 200+ countries

- Prepaid Mastercard for worldwide spending

- Bank transfer to local accounts

- Integration with marketplaces such as Amazon, Upwork, or Fiverr.

Bottom line: Despite the fees that I wish didn’t exist, Payoneer remains a reliable cross-border payment solution for international individuals and online businesses, especially in regions where PayPal and other alternatives have limited availability.

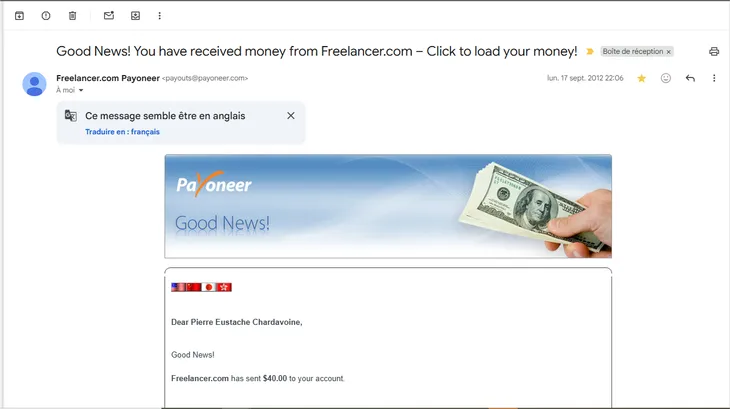

I received the first of many payments via Payoneer on September 17, 2012, for a freelance project I completed. Since then, it has helped me receive payments from ad networks, affiliate programs, and marketplaces for digital products.

What is Payoneer?

Payoneer is a financial services company founded in 2005 that specializes in cross-border payments for businesses and professionals. It makes it possible to receive payments globally and get them into your local bank account.

Payoneer primarily serves freelancers, e-commerce sellers, and digital service providers who need to receive payments from multiple countries. It’s a publicly traded company on NASDAQ (PAYO) and regulated by financial authorities in multiple jurisdictions. The company serves over 5 million customers.

The platform operates in 200+ countries and supports over 150 currencies. For someone like me who started receiving freelance payments and affiliate commissions from the US while living outside the USA, this worldwide reach proved essential. By the way, PayPal and Stripe are still unavailable where I live. Wise is restricting features instead of adding for my country. I am happy Payoneer is an option.

Payoneer Key Features For Online Entrepreneurs

Payoneer has been standing for a long time as a cornerstone in the global payment space. It offers a multifaceted platform to treat global payment as if it were local transactions.

Whether you are a freelancer on Fiverr, a seller on Amazon, or a digital nomad renting out space on Airbnb, the platform acts as a financial hub that simplifies how you interact with diverse income streams.

From virtual receiving accounts to physical spending with a card, here are the key features of Payoneer that will keep your business moving forward.

Payoneer’s receiving accounts

This represents its core value proposition. You get virtual bank account details for major currencies, including USD, EUR, GBP, and others. When a company pays you, they send funds to these accounts as if they were paying a local vendor, eliminating international wire transfer complications and fees.

I use these features constantly with affiliate networks. For over twelve years, I’ve received payments this way from companies in the United States and Europe. Instead of dealing with expensive international wires, they simply initiate a domestic ACH or SEPA transfer to my Payoneer receiving accounts.

Prepaid Cards

The Mastercard provided by Payoneer functions as a prepaid debit card linked to your account balance. You can use it for online purchases, in-store transactions, or ATM withdrawals worldwide.

This feature proves particularly useful when traveling or making purchases in currencies you don’t regularly hold. Currency conversion happens automatically when you withdraw funds to your local bank or spend in a different currency than you’re holding.

It does not come with your account automatically. It’s optional. You can request physical and/or virtual debit cards.

For transactions involving currency conversions, Payoneer’s exchange rate is competitive compared to traditional banks but above mid-market rates. For that reason, I limit transactions to the same currency and primarily use my card online. There are also fees for ATM withdrawal, which is why I favor the virtual prepaid card. I withdraw from my local bank for local purchases.

To request a Debit card, physical or virtual, you must have received $100 in your Payoneer account in the last six months. The first card costs $29.99 per year, and additional cards are free.

Integration with Partners

Marketplace integrations eliminate payment friction with major platforms. Payoneer connects directly with Upwork, Fiverr, Amazon, Airbnb, Dreamstime, and dozens of marketplaces. These integrations saved me significant hassle when I was freelancing heavily in 2013-2015.

Find a list of Payoneer partners: earnings sites that pay via Payoneer.

Payoneer partners can help you save when receiving money if used wisely. While the fee for receiving accounts is 1%, Payoneer partners are sometimes free or charge a $3 fee. Here is an example:

| Amount received | US Bank account (1% fee) | Payonner Partner ($3 fee) |

|---|---|---|

| $100 | Take a $1 fee. You get $99. | Take $3. You get $97. |

| $500 | Take a $5 fee. You get $495. | Take $3. You get $497. |

| $2000 | Take a $20 fee. You get $1980. | Take $3. You get $1997. |

Withdraw to your Local Bank

Bank transfer functionality lets you move money from your Payoneer balance to your local bank account. Transfer times vary by country but typically complete within 2-5 business days.

I’ve seen delays of an extra day or two, but I’ve never experienced a failed transfer to my bank. I limit frequent withdrawals because there are minimum fees from both Payoneer and my local bank. I send money to my bank when the 4% fee from Payoneer and the 0.5% from my bank is above the minimum fee of $15.

So, given the example above, if I receive $500 from a Payoneer partner and decide to send it to my bank, I’d receive $462. Breakdown: $500 - ($3 fee) - ($20 as Payoneer 4% withdrawal to bank fee) - ($15 minimum fee from my local bank).

For comparison, I’d receive $482.5 with Wise (but it’s not as widely available, nor as widely accepted as Payoneer). Receive ACH free, 0.5% to send to my local bank, 0.5%, but $15 minimum from my local bank.

That’s why I use multiple payment options and weigh the pros and cons on each transaction.

If I needed to save more on fees, I’d buy what I want online in the same holding currency.

By the way, I understand that it’s business at the end of the day. A company that is not profitable in selling its services will fail. Likewise, I am not judging by sentiment or even loyalty. I use the service that saves me money and gives me stellar service.

Payoneer Checkout to Sell Online

Payoneer allows sellers to accept payments from PayPal and credit cards in their online stores. This functionality is one of the latest additions to the platform. It integrates with platforms like Shopify or WooCommerce.

They are gradually adding availability to more countries.

On top of that, Payoneer is working on supporting stablecoin on their platform.

Payoneer’s Pricing and Plans

Payoneer doesn’t charge a monthly subscription fee, which immediately makes it more accessible than some alternatives that require ongoing payments whether you use the service or not.

1% receiving fee applies to most incoming payments to your global receiving accounts. While this fee bothers me, context matters. Many international wire transfers cost $25-50 in flat fees. The percentage-based model can still save you money for recurring affiliate commissions or regular freelance payments.

Bank withdrawal fees vary by country and typically run 1-4% with a minimum charge. Currency conversion spreads as another layer of cost when exchanging between currencies. I minimize this cost by withdrawing in the same currency I receive whenever possible.

Payoneer charges $3.15 plus a percentage (typically 2-3%) per ATM withdrawal. I rarely use ATMs with Payoneer because these fees accumulate quickly.

Account inactivity shouldn’t trigger fees if your balance is zero. But Payoneer charges $29.99 annually if you received less than $6000 the previous 12 months (calculated each January). If you also order a debit card, count another $29.99 per year for the first card.

You’ll pay fees while using Payoneer for many things.

However, Payoneer’s services are crucial in many areas with limited options. While I weigh its fees when using the service, I acknowledge that it is cheaper than many other options that I have.

- International wire transfer: often $30-50 per transaction.

- Western Union business transfer: typically 0-5% fees.

It’s the reliability and global reach that justify these fees for my business. It’s not necessarily the cheapest possible option. But I also joke that it is cheaper than the taxes that I’ll pay on my income later. It’s about perspective; it’s not my net income until it reaches my bank account.

Payoneer’s Ease of Use

Opening an account took me about 15 minutes back in 2012. The process required email confirmation, basic identification documents, proof of address, and information about my sources of income. Modern account opening follows similar steps but with improved digital verification.

While verification procedures can feel tedious, it’s also why Payoneer maintains legitimacy with major companies.

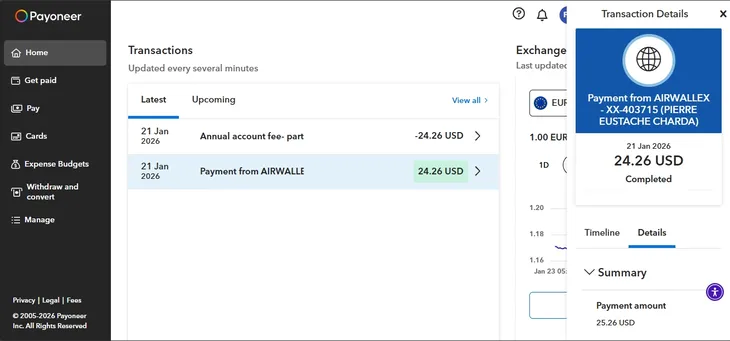

The dashboard gives straightforward access to your account balance, transaction history, and receiving account details. It’s functional.

Customer support operates through email ticketing and phone support during business hours. I’ve contacted support maybe 6-7 times over twelve years for various questions, and while not instantly responsive, they’ve resolved every issue eventually.

The core workflow –receive money, withdraw to bank– is intuitive enough that you’ll master it after a few transactions.

What I Like About Payoneer

Global accessibility stands out as Payoneer’s most significant advantage. I’ve received payments from affiliate networks, freelance clients, and marketplaces without geographic restrictions. When PayPal isn’t available in a particular country or limits functionality, Payoneer typically works. Otherwise, I could not have started this online business, AskEustache, back in 2013.

After 13 years, I can say confidently that Payoneer is reliable. In this article and throughout the site, you’ll find screenshots of payments received from Payoneer dating back to 2012. During that period, I’ve never lost money due to platform failure, and payments arrive predictably.

I like that it’s regulated; this provides peace of mind. Payoneer operates as a licensed financial institution under oversight from authorities in multiple jurisdictions.

Marketplace integration is convenient when you’re working with multiple income sources.

The prepaid Mastercard provides genuine utility for international purchases. It’s 3D secure, and you keep full control in your dashboard. It comes in digital or physical form and is widely accepted by local and online merchants.

What I Don’t Like About Payoneer

Fee remains my primary complaint after all these years. While I understand the economics of payment processing, it still feels like money unnecessarily leaving my pocket. The fee is transparent and predictable, but each email I receive from Payoneer about their fee is an increase after consideration. Their last email increased the amount to receive yearly to waive annual fees from $2000 to $6000.

Currency conversion spreads above mid-market rates add costs that aren’t immediately obvious. I’ve learned to minimize this impact by withdrawing in the same currency I receive, but it remains a consideration.

Payoneer vs Alternatives

Payoneer vs Wise

Wise (formerly TransferWise) excels at currency exchange with midmarket rates and transparent fees, but it functions differently from Payoneer. I use both services for different primary purposes: Payoneer for receiving payments to spend with a debit card, Wise for receiving multiple payments without fees.

Payoneer Pay can be used as a payment gateway for e-commerce stores. Wise doesn’t provide such an option. Payoneer offers physical and virtual debit cards, where Wise doesn’t serve.

For people leaving where PayPal or Stripe is not available to receive payments, Wise is not a replacement for Payoneer but an addition.

Payoneer vs PayPal

PayPal offers similar cross-border payment functionality but with more limited global availability and sometimes higher fees for receiving payments. I like Xoom from PayPal to send money to bank accounts globally with lower fees for small amounts.

However, PayPal is known for freezing accounts when you receive an unusual amount of money. Now that Payoneer account holders can receive money to Payoneer from PayPal, Payoneer is a smart choice for international users.

Who Should Use Payoneer?

Freelancers working with international clients represent Payoneer’s ideal user base. If you’re providing services through platforms like Upwork and Fiverr, it solves the cross-border payment problem elegantly.

Affiliate marketers receiving commissions from international networks benefit from Payoneer. Most major affiliate networks integrate with Payoneer or can pay to their receiving accounts.

Online sellers using Amazon, eBay, or other global marketplaces can receive payments through Payoneer’s marketplace integrations.

I also like Payoneer to buy stuff online for my online business. Also, people in regions with limited banking options or restricted PayPal access often find that Payoneer provides financial services otherwise unavailable.

Choose Payoneer id:

- You receive B2B payments from international clients or companies.

- You work on freelance marketplaces like Upwork or Fiverr.

- You earn commissions from international networks.

- You need multi-currency receiving accounts.

- You’re in a region with limited alternative payment options.

- You value platform reliability and regulatory compliance.

Not ideal for:

- person-to-person payments (if PayPal or Venmo is available).

- Primarily domestic transactions (local banks are simpler).

- very small irregular payments (fees become proportionally larger).

My Verdict on Payoneer Services

Rating: 4.25/5

After twelve years of use, Payoneer has proven itself as a reliable, globally accessible payment infrastructure for my online business. The platform’s worldwide reach and platform integrations help me accept its fees. The biggest strength is reliability.

Expect to pay around 2-5% in fees between receiving fees and withdrawal costs in most places. Some countries will pay significantly less, let’s say receiving US dollars in the USA is free for ACH, withdrawal to a bank is a fixed $1.5 for a certain amount.

Payoneer excels as an option for receiving business payments internationally.

I recommend it with honest acknowledgment of both its fees and its strengths.

Frequently Asked Questions

Is Payoneer safe and legitimate?

Yes, Payoneer operates as a licensed financial services company regulated in multiple jurisdictions. The company has operated since 2005 and serves over 5 million customers worldwide. Your funds are held in regulated accounts.

How much does Payoneer charge for receiving payments?

Payoneer charges 1% on incoming payments to global receiving accounts. While these fees aren’t negligible, they’re often competitive compared to international wire transfer fees or other cross-border payment options.

Which countries can use Payoneer?

Payoneer operates in over 200 countries and territories globally, making it one of the most geographically accessible payment platforms. However, the availability of specific features like local bank withdrawal varies by country.

Can I use Payoneer without a business?

Yes, Payoneer accepts individual freelancers and sole proprietors without a registered business. The platform works for anyone receiving professional payments, whether you’re a freelancer, affiliate marketer, consultant, or online seller operating as an individual.

Can I withdraw Payoneer money to my bank account?

Yes, you can transfer funds from your Payoneer balance to your local bank account in most countries where Payoneer operates. The withdrawal process takes 2-5 business days, typically, while fees range from 1-4% of the withdrawal amount (often with minimum charges).

Read next:

- Payoneer Partners: List Of Money Making Programs That Pay Via Payoneer

- Top Print on Demand Sites That Accept Payoneer in 2026 (Ranked & Reviewed)